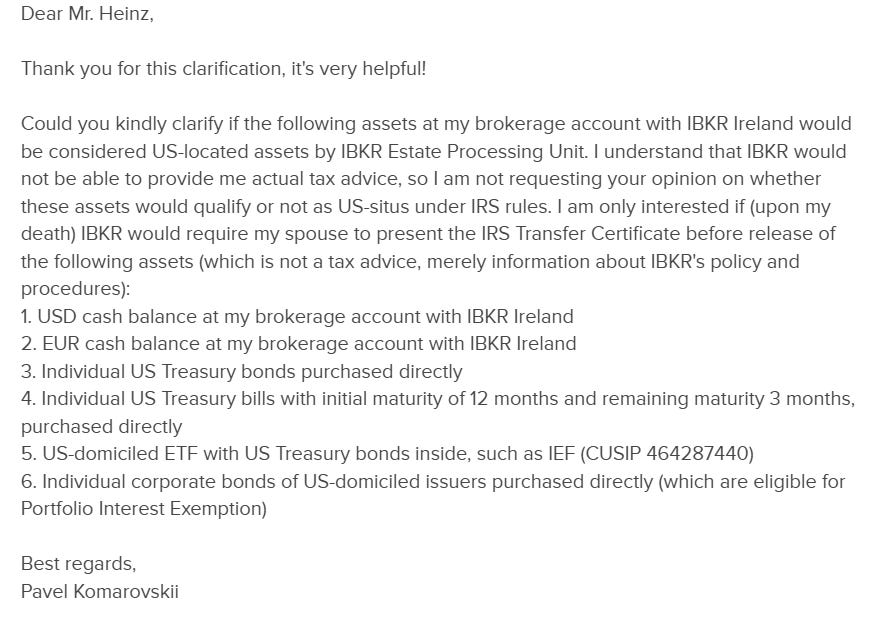

I pestered IB’s support team and got a detailed response about how they classify assets in a brokerage account as «US-situs / non-US-situs» (I was lucky to get Mr. Heinz from their ketchup inheritance department). Unfortunately, at the end of his response, he added, «Please note that these policies are subject to change and are not intended for publication,» so I can’t share their actual reply – the screenshot below only shows the questions I asked. But nothing stops me from sharing the conclusions from my interaction with IB’s support in my own words, which I’ll do below. =)

Please note that IB is not authorized to provide clients with tax or legal advice regarding the interpretation of U.S. tax law. However, they can clarify their own actions: which assets they will freeze after the account holder’s death and not release without an IRS Transfer Certificate, and which assets can be freely accessed without proof of paying the U.S. estate tax.

I think IB takes a maximally conservative approach here, and if they don’t consider an asset US-situs, it’s almost certainly not. In any case, if your «U.S.-situs assets according to IB» total less than $60,000, your heirs will likely be able to claim the entire capital without needing to deal with the U.S. IRS (I doubt they’d voluntarily contact the IRS to clarify nuances).

Overall, IB’s support confirmed the main conclusions from my article on the US inheritance tax (I didn’t ask about U.S. company stocks or ETFs – it’s already clear they’re considered U.S.-situs assets):

1–2. Cash balances in a brokerage account with IBKR Ireland (IB’s Irish subsidiary) – ✅ NOT considered US-situs assets, regardless of currency (i.e., even if the cash is in dollars). However, cash balances in the US-based IBKR LLC (where accounts for Russian residents are opened) should be considered US-situs assets – this wasn’t in the response since I’m a client of IBKR Ireland.

3. Direct investments in US Treasury Bonds – ✅ NOT US-situs assets.

4. Direct investments in short-term U.S. Treasury Bills with a remaining maturity of less than 6 months – 🚩 US-situs assets.

5. A US ETF holding those same US Treasury Bonds – 🚩 US-situs assets. This means it’s less advantageous to hold bonds through a fund, as wrapping them in an ETF somehow strips them of their «non-US-situs nature» for US Estate Tax purposes.

6. Direct investments in corporate bonds from U.S. issuers, where the broker does not withhold tax at source on coupons due to the Portfolio Interest Exemption (this allows foreign investors in U.S. bonds to avoid the standard 30% withholding tax on distributed income) – ✅ NOT US-situs assets. This was the most interesting part of the response for me – since the vast majority of U.S. bonds qualify for this exemption, this is great news!

One question remains: do Russian residents qualify for the Portfolio Interest Exemption, given the current partial suspension of the U.S.-Russia double taxation treaty? ChatGPT confidently states that these are entirely separate matters, and Russians with an IB account shouldn’t face the 30% withholding tax on U.S. bonds (assuming they’ve submitted Form W-8BEN, of course). But if you’re a Russian resident and an IBKR LLC client and want to be 100% sure, ask support directly (you might also ask them to confirm whether cash balances in your account would be considered U.S.-situs and if IB would require an IRS Transfer Certificate before transferring them to heirs).