Structured Notes from VTB: How to Lose 14 Million Rubles on "Super-Reliable Bonds" in Just a Week

Imagine: you’re looking for a place to park your money for a week, and a bond selection service suggests – «grab this paper from the issuer with the highest reliability rating, you’ll get 1% profit in just five days!». The terms are good, you buy 21 million – and a week later, you get back only 7 million rubles. Fun? For the hero of this story, no need to imagine....

Everything in this story is simply wonderful. Look, there were these “bonds” from VTB with ticker C1-519 and maturity date of 10.09.2025. Just a few days before maturity, they were trading at 99% of par, and some guy decided to buy them for 21 million rubles. No kidding, earning 1% in five days is equivalent to a yield to maturity of 108% annualized (as helpfully suggested by Finam’s bond screener), a pretty good deal!

However, when the calendar flipped and September 10 arrived, VTB paid the holders of this paper just 32% of par (a separate kek – the “card” for this bond on Smart-Lab still confidently states «the bond will be fully redeemed at par on 2025-09-10»). So, the guy lost more than 14 million rubles literally in a few days. And he wasn’t alone: read the screenshots here full of investors’ suffering (and on the SL forum too).

It’s all because this wasn’t an ordinary bond, but a so-called «structured bond for qualified investors», with payouts tied to the quotes of a portfolio of five Russian stocks. If, at the maturity of this structure, at least one of those stocks traded below 85% of its “starting” price at issuance – VTB could redeem the bonds not at par, but minus that drawdown for that specific stock. And since the reference stock portfolio wisely included shares of the developer “Samolet”, which ultimately fell 68% – the bank paid the happy quals less than a third of par...

Sounds murky and unclear? Friends, that’s exactly what I wrote about in the breakdown of the Citi-NES-VEB structures case: that’s the whole point of such products – to make them as incomprehensible as possible for buyers, so you can stuff endless hidden margins into the issuer’s pocket. If the so-called «qualified investor» deep down doesn’t understand what they’re buying and how to value it properly – they can be legally left without pants! In that sense, the few percent of lost annual income in the VEB case looks downright merciful: there, after all, they were selling the product to respectable people; but from ordinary mass no-name investors, you can easily skim off 68%.

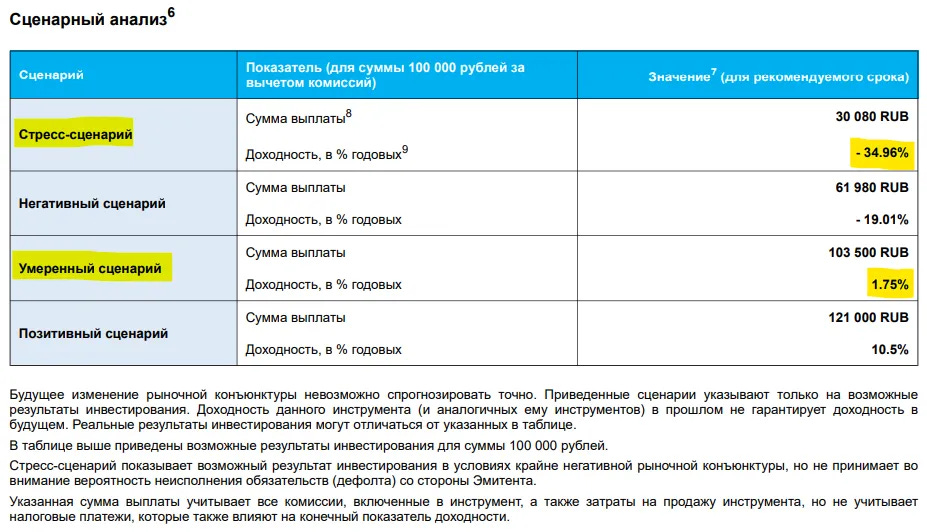

It’s clear that the outcome under consideration for VTB’s structured bonds with such a huge loss is extreme. But the fact that these papers were inherently unprofitable for investors even at issuance is obvious even from a simple “back-of-the-envelope” calculation. Let’s look at the passport of this structure.

The bond was issued on 13.09.2023 for two years with a 15% annual coupon. At that time, risk-free government OFZ yielded 13.8%. So, VTB’s structure promised a measly 1.2% annual premium, but it had two devilishly unfavorable conditions for investors:

If at least one of the five stocks in the «reference portfolio» falls more than 15% by maturity, the issuer redeems the bond minus that «discount from par.

If on the date of any quarterly coupon payment before maturity all five stocks are trading above their starting quotes at issuance (read: if markets are at highs and the probability of a 15% drawdown in at least one paper sharply decreases), the issuer can early redeem the bond at par – well, because in this situation, it’s no longer as fun to anticipate paying investors less than they initially invested...

What’s the point for an investor to take such a paper – honestly, I don’t know (unless you just didn’t figure out exactly what you’re buying). You get a yield 1% above OFZ (but that’s not accurate, the paper might be early redeemed), and in return, you take on the risk of getting back three times less than invested. How likely do you think it is that at least one (!) of five highly volatile Russian stocks will drop more than 15% over a two-year horizon? Yeah, that’s the whole point.

Final conclusions on structures for the gullible:

🐌 Never touch structured products even with a ten-foot pole – they’re designed specifically to strip you naked in an unobvious way. Especially run fast from those structures that someone insistently offers you to buy («personal investment manager from the bank», those guys). If you’re not a professional options trader with deep knowledge of the math, in 99.9% of cases, the product offered to you will be very disadvantageous for you.

🐌 If you see such a juicy opportunity in some screener or broker app (like a 108% annual yield) that it looks «too good to be true» – it’s probably not true.

🐌 There’s an intuitive sense that the Bank of Russia as regulator should put a bit more effort into ensuring that ordinary (not super-savvy in finance, though proudly wearing the «qualified» badge) investors don’t confuse different types of bonds. Because in the passport of VTB’s structure, it’s honestly written «in the base scenario, you’ll get 1.75% annual yield, and in the worst – you’ll lose two-thirds». But when a casual investor goes into some screener and sees there «bond from an AAA reliability issuer, 108% annual yield, guaranteed redemption in a week at 100% of par» – most won’t even think to look for any «product passports»...